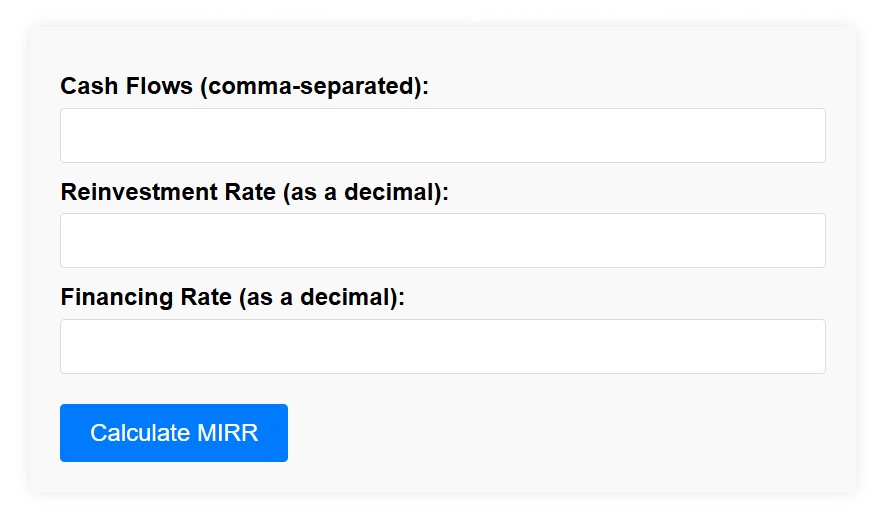

How Does the MIRR Calculator Work?

Let us understand some of the terminologies that serve as parameters for the MIRR calculator –

Cash Flows – Incoming cash or financial aid at given periods of time.

Reinvestment rate – The assumed rate of investment of profits or positive cash flows. MIRR assumes reinvestment rate at the firm’s cost of capital, aka, the expected return of the project.

Financing rate – The assumed rate of financing negative cash flows, like loans, leases, brokerage, contracts, etc.

MIRR Formula Explained

To calculate the MIRR, the formula used is:

Where:

- Terminal Value (TV): Sum of future values of positive cash flows.

- Present Value (PV): Sum of present values of negative cash flows.

- n: Number of periods.

The MIRR takes into account the sum of the possible future values of positive cash flows and the present values of negative cash flows.

If the computed MIRR from the MIRR calculator is higher than the expected return of the project or investment plan, it is worth continuing the investment. In contrast, one must not take up an investment if the MIRR is lower than the expected cost of capital.

Also, a negative MIRR indicates that the investment will not yield the required cost of capital.

How to Calculate MIRR: A Real-Time Example

Assume you are interested in a project with an initial investment of $1000. You anticipate to get cash flows every year as follows:

- Year 0: -$1000 (initial amount)

- Year 1: $2500

- Year 2: -$3000 (due to a loan)

- Year 3: $4000

Let us assume a reinvestment value of 8% and a financing rate of 10% for the period of 3 years.

The sum of negative cash flows is

PV = -1000 + (-3000)/(1 + 0.10)2 = $3479.34Here, we can see how the negative cash flow in year 2 is discounted at the end of the 3 year period.

The sum of positive cash flows is

TV = 2500 *(1.08)2 + 4000 = 6916Here, we see how the present value of the investment made in the second year is compounded at the end of the period.

Therefore, MIRR = ∛(6916/3479.34) - 1 = 0.2573, which is 25.73%

This value signifies that this investment fetches positive returns amidst varying cash inflows and outflows.