About MIRR

For most businesses and investors, the ideal way to utilize their profits is to reinvest them in the same venture. But how can one check for the feasibility of these reinvestments to yield higher profits?

To check for an investment's overall attractiveness and profitable returns, we use the Modified Internal Rate of Return (MIRR). It is a modification of the internal rate of return (IRR) metric, considering variable reinvestment rates and times of reinvestment.

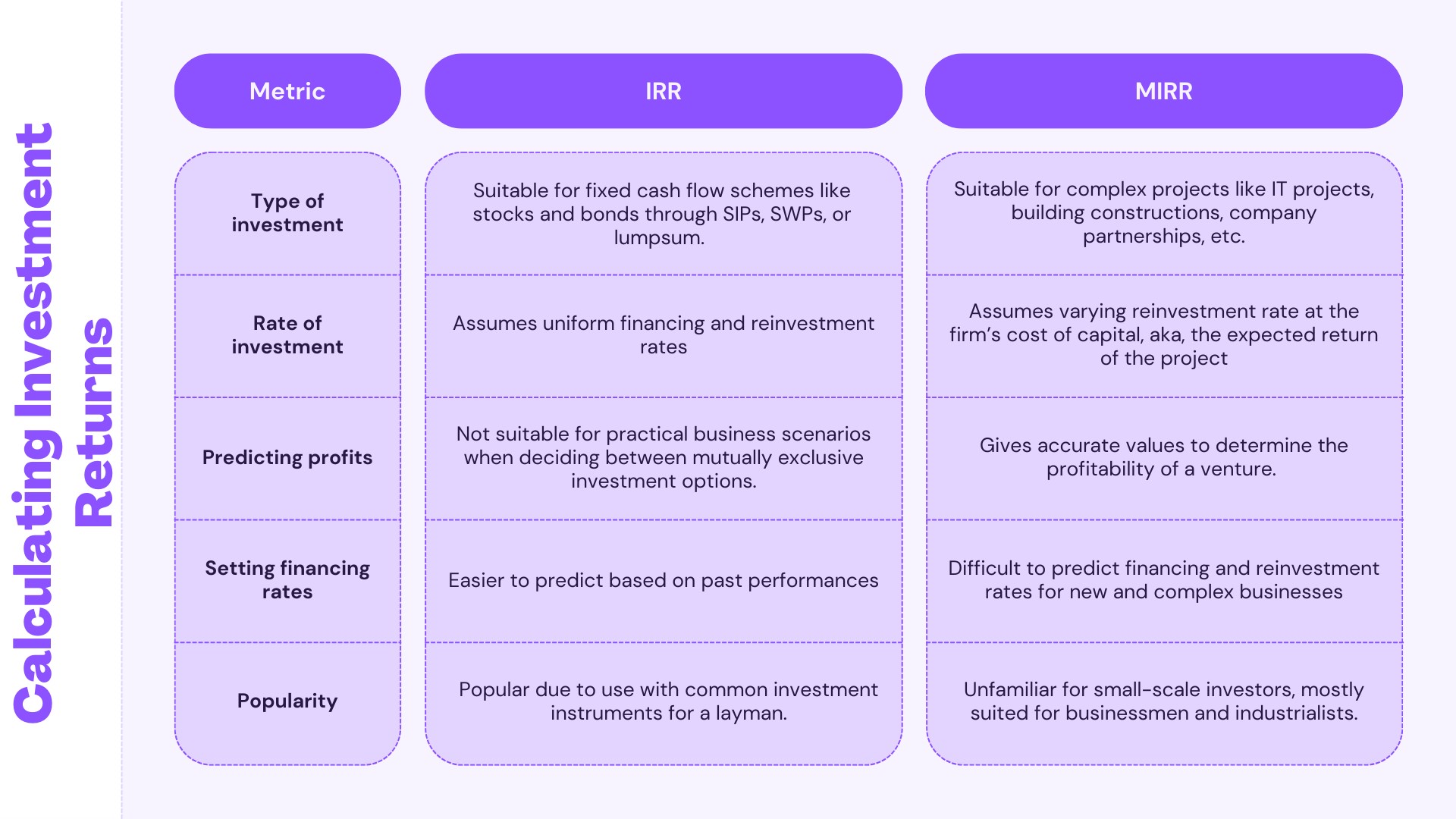

The difference between MIRR and IRR is that IRR is suitable for investments with only one final cash flow or straightforward cash flow. No wonder investors look for IRR values while investing in funds, stocks, and bonds through SIPs, SWPs, or as a lump sum.

However, in complex projects like IT projects, building constructions, company partnerships, etc., there can be several positive and negative cash flows at different times.

IRR assumes that positive flows are reinvested at a uniform rate and negative outflows are financed at a similar rate. This limitation is addressed by MIRR. This method provides a more accurate evaluation of an investment’s profitability especially when comparing mutually exclusive project choices.

IRR can be confusing and produce different values in such scenarios because IRR does not take into account the time of reinvestment.

IRR Disadvantages

- Assumes positive cash flow reinvestment happens at the same rate as the IRR.

- Generates multiple values depending on the period of incoming cash flows.

- Does not work for complex projects with varying cash flows and reinvestments.

- Not suitable for practical scenarios when deciding between mutually exclusive investment options.

MIRR thus came as a more reliable value to overcome the shortcomings of IRR. Moreover, MIRR is reliable for reinvestments happening at a rate decided by external factors. So, MIRR becomes the natural choice for complex projects with several positive and negative cash flows.

Advantages of the MIRR Calculator

Know about when and where MIRR calculators are helpful for investors.

- Ideal for plans where cash flows are reinvested (positive flow) at variable rates and financed (negative flow) at another rate.

- Considers real-time scenarios and assessments when assuming reinvestment rates.

- Returns the same or similar value for the same cash flows, reinvestment rate, and finance rates at different time intervals.

- Helps investors rank promising investment plans or projects for possible investments.

- A free tool with a helpful tutorial to aid you in assessing several schemes and projects in a short time.

- Use this tool from any browser on desktop and mobile devices.